Graphite and Gold = Perfect Hedge?

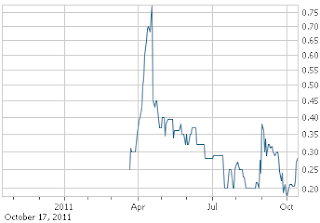

Share Price: 28 cents

Shares O/S: 30 Million

Market Cap: 8.4 Million

Rating: Strong Buy

Ticker Symbol: SRK

Ticker Symbol: SRK

On this week’s edition of Resource Corp I will be featuring a hot new company that has their hands in pretty much every basket. Strike Gold, a major player in the graphite industry, has recently acquired a game changing project from Canaco Resources.

In addition to the current Satterly Lake property in Ontario, Strike Gold announced yesterday that they will be entering into a joint venture with Canaco Resources. For those of you unfamiliar with Canaco, they are a key player in Tanzania. An updated resource estimate for Canaco is currently in the works, but based on my analysis, it can be estimated easily to the tune of 5 million ounces.

In addition, the Boma property in Tanzania is accessible by paved highway; always an unexpected delight to those familiar with African exploration.

The Boma property has never been drilled or mapped with modern geological technology which means this property has blue sky potential. Multi-million ounce deposits are the norm in the surrounding region, making this property the quintessential property of elephant territory.

The geological landscape of Boma is very similar to the Handeni property, Canaco’s flagship project. Based on preliminary assessments, Boma is expected to hold yields similar to those of Handeni Property.

|

| Property Overview Map |

The Boma property is also along the same corridor that currently hosts two active gold mines. Scaling in at nearly 562 square kilometers, the Boma property is massive. This property truly has the potential to be multi-million ounce project. Naturally, with Canaco on board, Strike Gold will have no issues dealing with the authorities in Tanzania, which is always attractive to investors.

I will be following this project very closely as more geological work, specifically airborne surveys and on-the-ground sampling becomes available. I will be updating the blog regularly. I truly believe that this property has the potential to be a multi-million ounce deposit.

Project highlights:

- Connected by Highway

- Joint Venture with Canaco

- Elephant Territory

- Large Land Base

In addition to this new property, Strike Gold has also made advancements in Ontario, which includes the Satterly Lake Project. There has been much historic drilling on this property which is not yet NI 43101 compliant.

Highlight drill hole to date:

- 1.37gpt over 117m

There has also been very positive grab samples, Ontario is having a renissance simlar to the gold rush with companies like Augen Gold, Trelawney, and Gold Canyon which I recently featured in an ariticle a few months ago. The property hosts sulfides that are all usually gold bearing;the geological landscape of this project looks similar to springpole lake. The Bircho-Urchi greenstone belts are similar to Red Lake, where Goldcorp has a flagship-mining prokect. The red lake mining project has one of the lowest cash costs coming in at 288 dollars a oz.

There has also been very positive grab samples, Ontario is having a renissance simlar to the gold rush with companies like Augen Gold, Trelawney, and Gold Canyon which I recently featured in an ariticle a few months ago. The property hosts sulfides that are all usually gold bearing;the geological landscape of this project looks similar to springpole lake. The Bircho-Urchi greenstone belts are similar to Red Lake, where Goldcorp has a flagship-mining prokect. The red lake mining project has one of the lowest cash costs coming in at 288 dollars a oz. The Next Critical Metal?

Strike Gold also hosts two great high grade graphite deposits, for those of you guys thinking WTF is graphite? I have a paragraph below explaining the importance of this metal.

Graphite 101

A key reason that I like Strike Gold is in addition to the gold is because the company has 2 world class graphite exploration plays. The demand for graphite is rising at astronomical rates. The need for lightweight and high strength Carbon fibre is creasing as the world moves to more fuel efficient cars/jets for example the new Boeing dream liner is made almost entirely out of carbon fibre. This is supposed to be the replacement for the aging 747. Graphite is also used in nuclear reactors, fuel cells, batteries, solar cells, and most importantly in hockey sticks used by the NHL greats!

A key reason that I like Strike Gold is in addition to the gold is because the company has 2 world class graphite exploration plays. The demand for graphite is rising at astronomical rates. The need for lightweight and high strength Carbon fibre is creasing as the world moves to more fuel efficient cars/jets for example the new Boeing dream liner is made almost entirely out of carbon fibre. This is supposed to be the replacement for the aging 747. Graphite is also used in nuclear reactors, fuel cells, batteries, solar cells, and most importantly in hockey sticks used by the NHL greats!

With great demand like this, I can see China curbing their exports. This is an highly expected move by China because they also curbed their exports of Rare Earth Metals in the past year. North America is becoming considerably more aware of factors such as these so I believe they will be working hard to secure critical supply of these niche metals.

Recently Graphite prices have hit $3000 dollars/ton. Although they have pulled back recently with this bear market, they have made great moves that can only be matched by the tremendous rise in gold prices. Graphite is clearly in a bull market rally I believe this trend will continue as we become more sophisticated and more aware of the environment.

I will not get into detail about the Graphite deposits at this time but here are the highlights for more information on them check out the Powerpoint Presentation

Now is a great time to buy Strike Gold as there will be a sister company known as Strike Graphite, with a market cap like this it is clear the Graphite assets are being valued at ZERO, so a spin out will get the graphite projects the value they deserve.

Now is a great time to buy Strike Gold as there will be a sister company known as Strike Graphite, with a market cap like this it is clear the Graphite assets are being valued at ZERO, so a spin out will get the graphite projects the value they deserve.

- Politically stable location (Saskatchewan)

- Very high grade vs. peers

- One of the only graphite explorer’s on the venture

- Fast tracking potential

- Spin out will value graphite assets

The Hunt For The Next 10 bagger!

The company trades with a tiny market cap of about 8.4 million, for a company with 4 world class exploration projects I think this is very low. Expect a gradual rise in share price as the company matures, this is a very new company that was recently formed and with more promotion and awareness things are going to change QUICK! This company over higher than 10 bagger potential! It still only has a market cap of 84 million as if it were ten bags! Not often do you get a chance to get in at the ground floor! Now is your chance to grab it by the horns! If you act now you will get a FREE share of Strike Graphite!

The company trades with a tiny market cap of about 8.4 million, for a company with 4 world class exploration projects I think this is very low. Expect a gradual rise in share price as the company matures, this is a very new company that was recently formed and with more promotion and awareness things are going to change QUICK! This company over higher than 10 bagger potential! It still only has a market cap of 84 million as if it were ten bags! Not often do you get a chance to get in at the ground floor! Now is your chance to grab it by the horns! If you act now you will get a FREE share of Strike Graphite! In conclusion to this short blog, I rate Strike Gold a screaming buy, the graphite and gold projects hedge each other out very well in my opinion. Graphite is a play on the industrial strength of the economy while gold is a great hedge to have if the economy goes in the gutter again! You can't lose on this one folks.

For More Information Visit www.strikegoldcorp.com

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/sp_en_8.gif)